QE3- Its Mechanisms & Effectiveness

Quantative Easing is always a hot topic in the news. How much do you know about the recent QE3 announced by the Federal Reserve? This blog aims at discussing the operations of quantitative easing and the impacts of QE3 on various aspects.

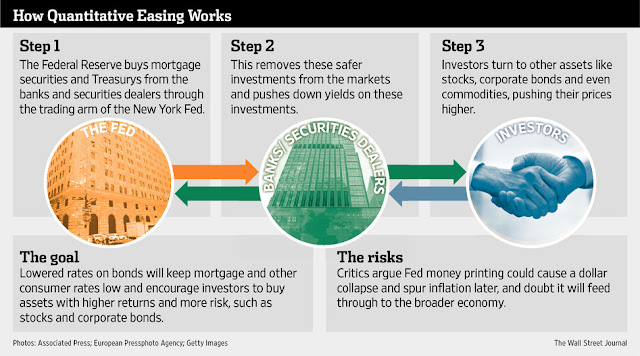

The Fed launched a new bond-buying program on September 13. The image below by Wall Street Journal gives a very clear illustration on how the Fed expects to boost the economy by buying more mortgage-backed securities and Treasurys.

What's Distinguishes QE3 from the previous QE1 and QE2?

The biggest differentiation would be the "open-endedness" that the Fed has promised. Under the QE3 program, the Fed would buy $40 billion mortgage-backed securities each month in an open-ended effort until there is a sustained improvement in the job market. Therefore, on top of the $45 billion a month the Fed is already spending on Operation Twist through the rest of this year, the Fed is spending $85 billion per month to boost the economy. Moreover, the Fed also said that the federal funds rate would stay near zero "at least through mid-2015," in order to "support continued progress toward maximum employment and price stability." However, another open-ended question here concerns the targets for jobless rate or high inflation.

Look at the diagram above. Unemployment and inflation rise to the original level after our previous quantitative easing programs. Remember, every new QE program signals the Fed's admission to the failure of achieving goals' of the previous QE program. Yes we have QE1, QE2, and Operation Twist, but unemployment is still above 8%. While macroeconomic factors such as European Debt Crisis might have affected the US recovery, I believe the Fed is bearing more inflation risk than the possible return- lower unemployment.

~Sophie Tam

Comments

Post a Comment